All Categories

Featured

Table of Contents

TAKE TIME TO READ IT. Do not let one representative or insurance firm stop you from getting details from one more representative or insurance firm which may be to your benefit.

In this manner you can be sure you are choosing that remains in your ideal rate of interest. We are called for to notify your existing firm that you might be changing their policy. 1. If the policy insurance coverages are basically similar, costs for a new plan may be greater because prices raise as your age boosts.

If you borrow versus an existing plan to pay premiums on a new plan, death benefits payable under your existing policy will be reduced by the quantity of any type of unsettled car loan, including overdue interest. Surefire rate of interest prices are normally substantially reduced than current rates.

Instant Life Insurance Quotes

Are premiums ensured or conditional - up or down? 7. Taking part plans pay dividends that may materially decrease the expense of insurance over the life of the agreement. Returns, nevertheless, are not guaranteed. 8. CARE, you are urged not to act to terminate, assign, or change your existing life insurance protection up until after you have been issued the brand-new plan, analyzed it and have actually located it to be acceptable to you.

If you are not pleased with it for any kind of reason, you have the right to return it to the insurance company at its home or branch workplace or to the agent via whom it was bought, for a full refund of premium. 1161-2213I/ GA( 1206) P.O. Box 61 Waverly IA 50677-0061 Phone: 1-855-200-7101 If you have inquiries or require aid using, please offer us a telephone call.

For J.D. Power 2024 honor information, visit Irreversible life insurance coverage creates cash money worth that can be obtained. Policy finances build up rate of interest and unsettled plan finances and rate of interest will minimize the death benefit and cash worth of the plan. The amount of cash money value offered will generally depend upon the kind of permanent policy acquired, the amount of insurance coverage bought, the size of time the plan has been in pressure and any kind of exceptional policy fundings.

Disclosures This is a general description of coverage. A total statement of coverage is discovered just in the plan. For even more details on coverage, costs, restrictions, and renewability, or to make an application for coverage, call your regional State Ranch agent. Insurance coverage policies and/or connected motorcyclists and attributes might not be readily available in all states, and policy conditions might vary by state.

Since you have identified how much you need, hopefully the insurance provider will certainly use you that quantity. Insurance companies utilize multipliers as explained above and will not provide you with even more insurance coverage than they assume you require, based on their solutions. There is some versatility there, so if you have needs that exceed these formulas, your representative can help you "offer your instance" to the underwriter.

Life Insurance Instant

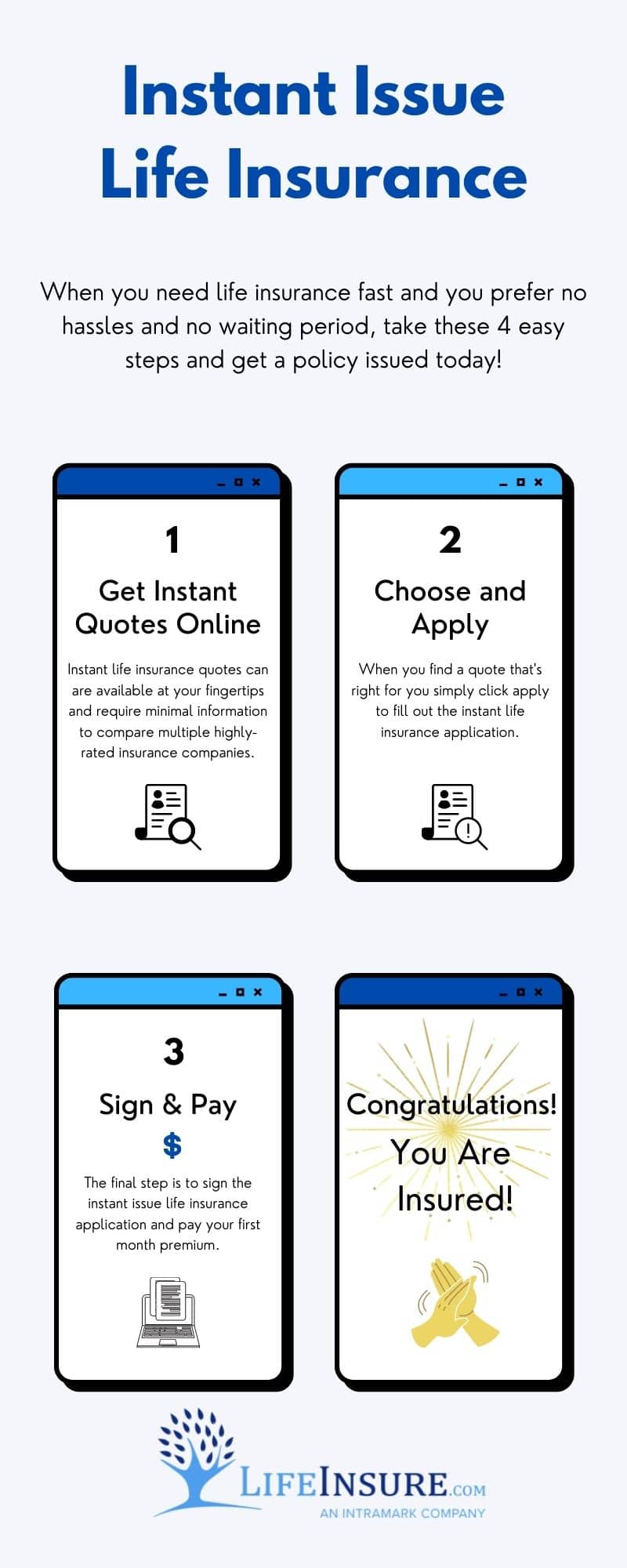

Derek is a Qualified Economic Organizer and earned his Ph. D. in Personal Financial Planning at Kansas State College. He can be gotten to at [email protected]. Check out more of Derek's articles right here. As the life insurance policy underwriting landscape proceeds to develop post-pandemic, people increasingly have access to "instant-issue" term insurance policy options that cut out most of the typical underwriting needs and seek to offer a choice simply minutes after sending an application.

It might be practical to give some interpretations relating to exactly what "instant-issue" refers to considering that there is some obscurity in exactly how terms are made use of and that can create complication. At a really high-level, we can organize the underwriting of term insurance policy items presently on the marketplace into 3 broad buckets: Almost instantaneous choice after sending an application (much less than 15 minutes).

Insurance firms can change their very own underwriting plans, and we may see evolution in what is typically needed over time. For the time being, these 3 categories do a pretty excellent work of defining the various paths that a person could pick to go down when purchasing term life insurance.

After submitting an application, people will certainly usually have decisions within mins, and the entire underwriting process is done. In order to use instant-issue insurance coverage at affordable rates and show up at a decision within minutes, service providers will certainly not be able to count on an Attending Physician Declaration (APS), medical exam, or lab work.

As an example, some service providers might have limits such as $2 million for instant-issue protection and a total of no even more than $5 million in complete life insurance policy for an individual getting instant-issue protection (note: these are just example numbers). In this case, it would be silly to come close to these service providers and make an application for $3 million of instant-issue insurance coverage or for any kind of coverage for someone that already has $5 million or more of insurance coverage in pressure.

Instant Insurance Life Quote Term

Likewise, if a provided provider won't provide instant-issue protection for an insured with a typical tobacco score, then it would not be smart to look for instant-issue insurance coverage for an insured that is estimated to have a basic tobacco ranking. It is worth noting that the danger of denial is higher for any individual predicting at the cutoff point for a provided kind of protection.

In the last situation, even if their rating does can be found in less than anticipated, they're likely to still be provided preferred non-tobacco rather than rejected altogether. It is worth noting that some carriers might choose to move a person from an instant-issue or increased underwriting track to standard underwriting entirely as a matter of randomly evaluating their own underwriting treatments and applicant swimming pool.

Life Insurance Quote Instant

As an example, a few of the pros of instant-issue life insurance policy are that the process of acquiring it is really fast and convenient, behavioral barriers are much less likely to be a concern given that there are no underwriting needs, and the application procedure is much less complex than that for various other forms of coverage.

And if the application is turned down, a denial would likewise need to be divulged upon requesting coverage with one more service provider. While the application process does not consist of a physical examination, the lack of a physical likewise makes it simpler for a life insurance firm to oppose a policy. Moreover, instant-issue policies generally provide a minimal death advantage and are usually not convertible.

Instant Term Life Insurance Quotes Online

Relying on just how rapid a person can make it through the insurance coverage surveys, it can take as little as 1530 mins to have actually accepted insurance coverage in position. In the context of consultants working with clients and specifically those dealing with collectors (in a project-based or per hour context) or much less upscale clients (that are met with less regularly) this advantage should not be underrated.

Lots of carriers will certainly also need that EFT payment information be provided as component of the application, so even the month-to-month payment can additionally be set up instantly and all set to go by completion of the conference. Any individual who has actually fought with obtaining clients to really execute life insurance policy might appreciate exactly how huge of an advantage this can be.

Coordinating insurer phone meetings, organizing medical examinations, altering one's mind concerning protection over a 1- to 2-month waiting period, discontentment with underwriting results, and objection to reboot the underwriting procedure have all been barriers I've directly seen to implementing term life insurance policy. Also for continuous clients, I've had clients that, in spite of my consistent pestering, took years to execute protection (instant coverage life insurance).

Life Insurance Quote Instantly

I directly really felt that I was not satisfying my fiduciary task to customers by introducing obstacles to carrying out term life insurance policy. Having the ability to give that service for my clients has reduced one collection of obstacles, and the ability to offer instant-issue insurance coverage has actually gotten rid of yet an additional set of obstacles.

Given, there's absolutely some health and wellness benefit for an applicant to find out about an unknown problem throughout underwriting, yet it is not unusual for a person to discover something concerning themselves throughout the underwriting procedure that could make their insurance coverage a lot extra costly, or even stop them from ever obtaining protection. With instant-issue coverage, however, a candidate just responds to questions regarding their health and wellness that requirement to be truthful since the moment they are addressing them.

Latest Posts

Final Expense Insurance Cost

Top Final Expense Insurance Companies

Top Final Expense Carriers